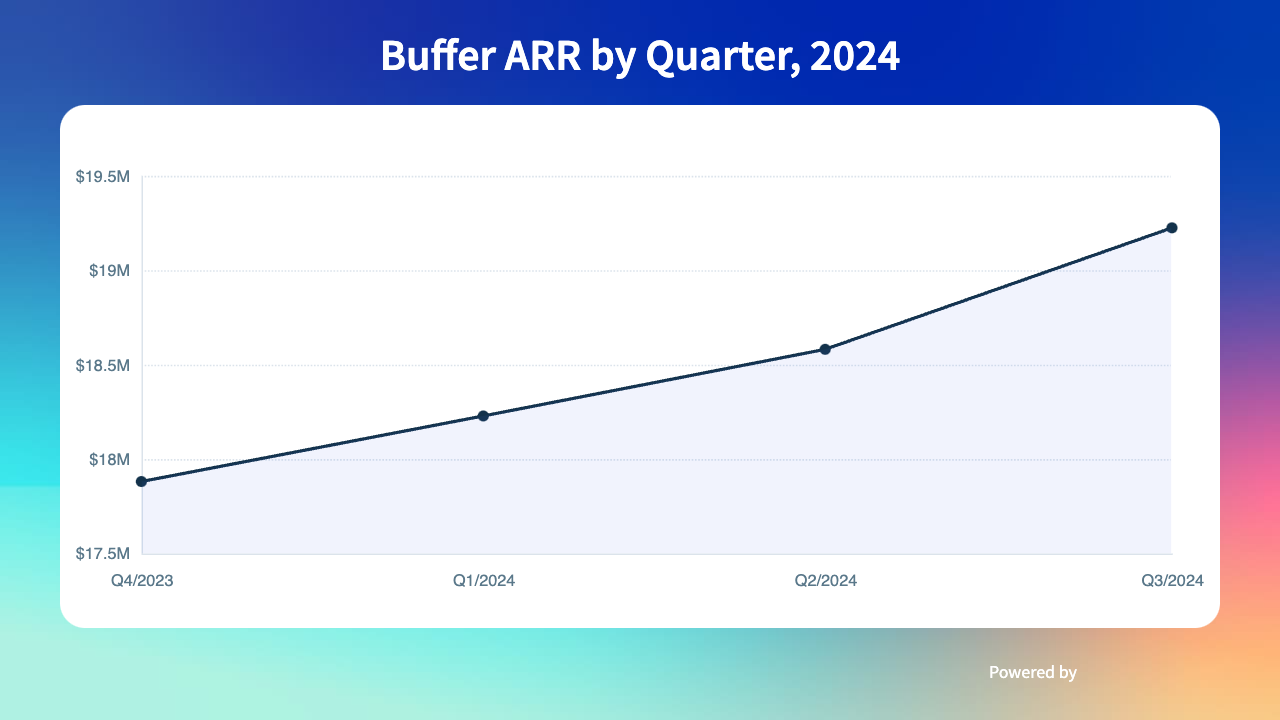

Here's a reflection on Buffer's Q3 which I recently sent to shareholders:

We ended Q3 2024 with $1,602,052 in MRR or $19,224,628 in ARR. This represents 3.46% growth from Q2, which is our strongest quarterly growth in almost 5 years. We also grew paying customers by 2.89% to 57,666, our strongest growth in over 6 years. We continued our trend from Q2 of profitability in each month of Q3, and achieved a net income of $125,289 for the quarter.

Segmenting out Legacy and New Buffer customers, we can understand the numbers and trajectory in higher definition. New Buffer now represents 83.2% of total MRR, and 80.2% of paying customers. We saw an MRR/ARR growth rate for the New Buffer segment of 7.82% for Q3.

The delta between our 7.82% growth rate for New Buffer vs our overall growth rate of 3.46% shows that we have a strong foundation of growth in our current and majority customer segment. In Q3 we added $83,427 in net MRR growth for New Buffer, with $12,861 (15.4%) of this coming from Legacy customers migrating over to our New Buffer plans, while Legacy Buffer as a segment declined by $30,259 in net MRR. This indicates that we will continue to see strong overall growth rates going forward.

The Legacy segment continues to decline as we are not adding any new customers to it, and it has a natural churn rate. In Q3 the Legacy segment declined by 13.81% to $268,974 in MRR or $3,227,693 in ARR. We are happily tracking the decline without aggressively forcing customers to migrate to New Buffer plans. Eventually we will aim to get this segment to zero, which will enable simplicity in our product, architecture and customer service.

I predicted in my Q2 update that Q3 would be the quarter we see an overall increase in the number of paying customers once again. We are celebrating achieving this, and looking ahead to how we can continue to achieve strong growth in both the number of paying customers and MRR/ARR so that we can see many more strong growth quarters ahead. I expect we will see a strong Q4 despite the usual seasonal dip in usage of our product during the holidays, thanks to a continued strong growth rate of New Buffer and the lessening pull down effect of Legacy as the segment declines.