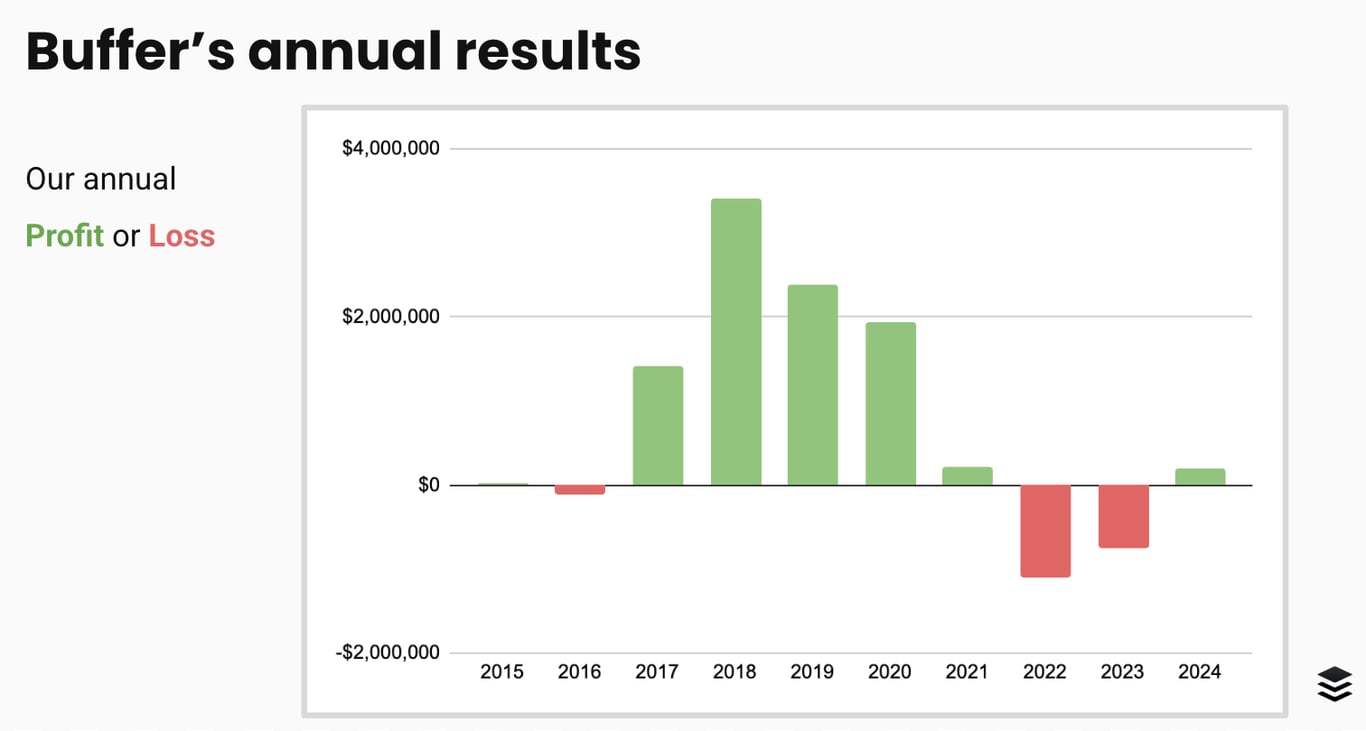

I recently shared that last year at Buffer we achieved our first profitable year of the past three. As a result, we carried out profit sharing again - something that's very meaningful to me as I'm focused on building a business where when we succeed as a team, we all reap the rewards of that success together.

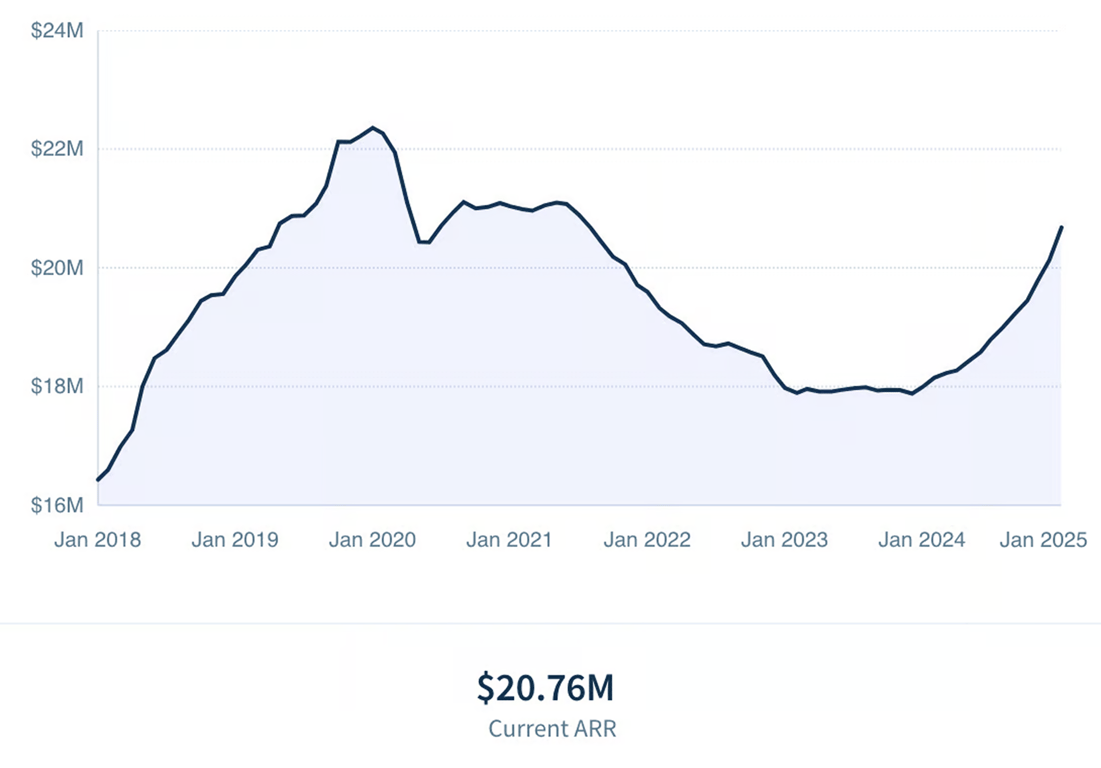

We achieved a net profit of $202,459, which for a $20M+ ARR business may not seem impressive. And indeed, in prior years we have achieved net profit in the millions.

But for us as a company, this has been a symbolic achievement in service of the path we have chosen. You see, we've been weathering a multi-year decline, and last year was our first year of growth since 2019 and our first profitable year since 2021.

Buffer has existed for more than 14 years now - you can't go that long without having a few tough years. I've grown and learned more from the years of decline than I ever could have by moving onto something else.

We've chosen to grow Buffer through revenue from customers, rather than funding. We haven't raised a round of funding since 2014. And we weathered these losses without conducting layoffs, which have been very prevalent during these years.

Turning around the decline took a shift in strategy and real dedicated execution from the entire team. We couldn't have done it without all coming together to make it happen. I'm not here to drive short term increases in profit, I'm here to build something lasting and significant with people I admire and love working with.

The years of decline were very tough to go through. I always had conviction we'd find our way back to growth and thriving, but I didn't always know exactly how. We had to discover the path through deep introspection of what made Buffer special in the first place, and getting much closer to customers again.

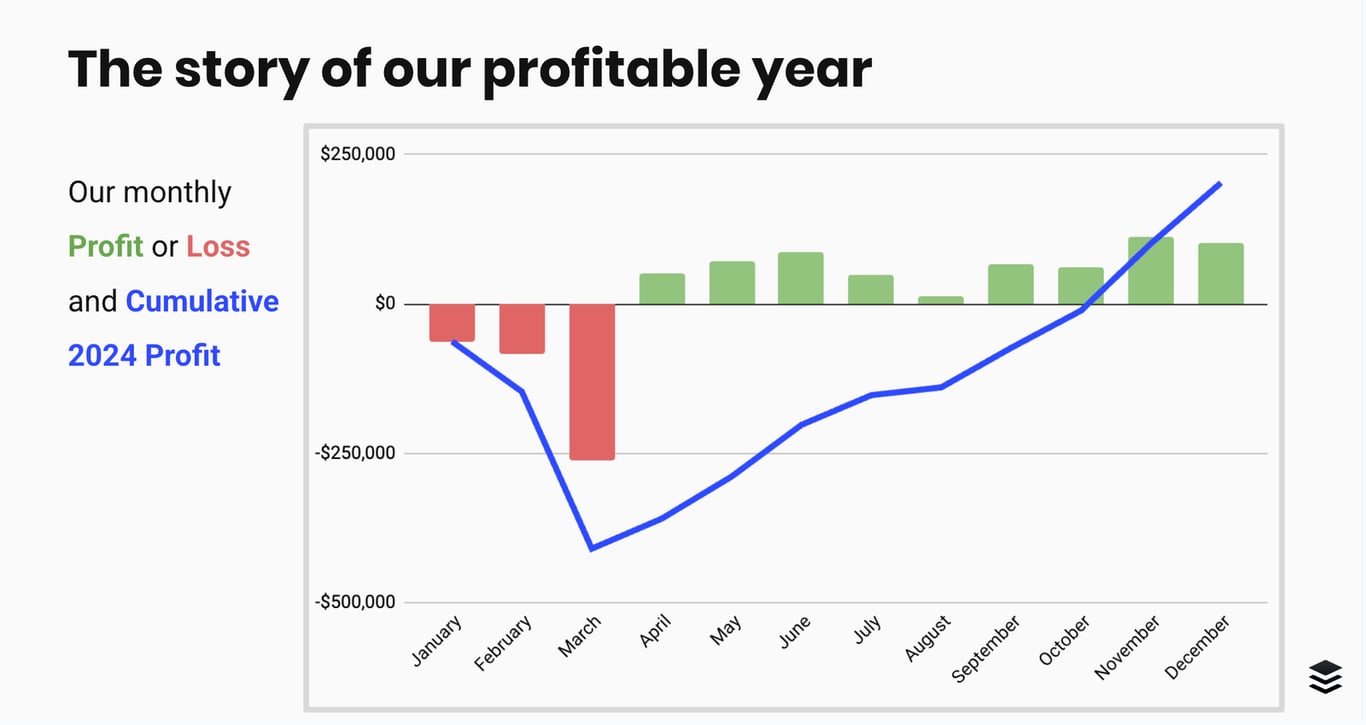

And that $202,459 net profit number for 2024 doesn't tell the whole story. To have a more comprehensive picture, we need to look at how we arrived at this profit.

We entered 2024 with losses as we were still enduring monthly losses. March was our highest expense month, as we had our annual company retreat, gathering the whole remote team in Mexico.

In April we turned a profit, and from that point onwards we gradually clawed our way back to break even and then profit. What's particularly noteworthy is that the bulk of our profitability was achieved in the final two months of the year.

The first ten months essentially balanced out to break even, but then November and December each brought in over $100,000 in profit, pushing us to that final $200,000 figure for the year.

Starting the year with this kind of monthly profitability as our baseline gives us a strong indication of what 2025 might look like.